Ministry Vision

To promote sustainable investments, exploration, mining, value-addition and beneficiation, marketing and management of mineral resources for the benefit of all Zimbabweans.

WELCOME TO THE MINISTRY OF MINES AND MINING DEVELOPMENT

The Ministry of Mines and Mining Development has its key deliverable as the generation of revenue for the Nation of Zimbabwe through mining. In the whole mining value chain the Ministry does business with a variety of external and internal clients. The Ministry makes a commitment to provide a service to the specified quality standards and within stated time limits.

QUICK STATS

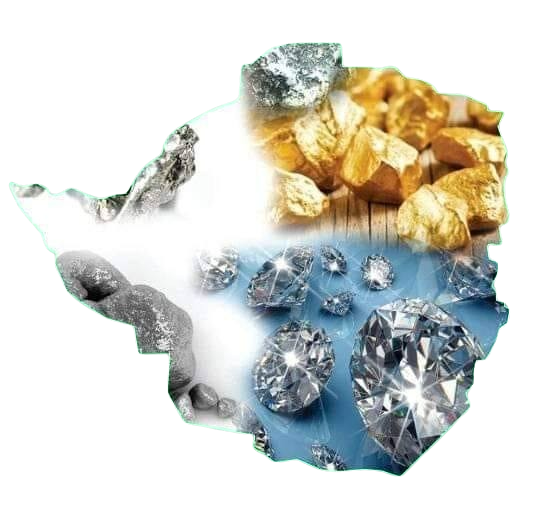

Zimbabwe Mineral Potential

Zimbabwe has a huge and highly diversified mineral resource base dominated by prominent geological features, namely, an expansive craton, widespread greenstone belts (also known as gold belts), the famous Great Dyke, Precambrian and Karoo basins and metamorphic belts. As a result of its good geology, the country has huge mineral potential characterized by about 60 economic minerals whose commercial profitability has been proven. The Great Dyke is a layered igneous complex extending north-south for about 550 km. The Great Dyke plays host to the world’s largest high grade chromite resource base. Zimbabwe has the world’s second largest resource of platinum group of metals as well as significant reserves of copper and nickel. With rock ages spanning a period of more than 3 billion years, Zimbabwe’s heterogeneous geological environment is favorable to occurrences of a variety of minerals and ore bodies.

• Who can mine in Zimbabwe?

Zimbabwean citizens who are at least 18 years old can mine in the country if they follow the required procedures and regulations.

• What are the most popular minerals mined in Zimbabwe?

Gold is the most popular mineral mined in Zimbabwe, but the country also mines platinum group metals, chrome, coal, lithium, and diamonds.

• How can I sell my gold?

All gold mined in Zimbabwe is sold to Fidelity Gold Refiners (FGR).

• How can I find a market for other minerals?

The Minerals Marketing Corporation of Zimbabwe (MMCZ) can help establish markets for minerals.

• What is a special grant?

A special grant is a type of mining title that allows the holder to mine in an area that is reserved for other land uses.

• How can I connect with investors?

The ZIDA Mining Claims Matchmaking Platform can help mining claim holders connect with potential investors.

• How do I renew my investment license?

An investment license must be renewed at least three months before it expires.

• What taxes apply to mining?

There is a special capital gains tax on the transfer of mining titles. There is also a levy on the sale of lithium, black granite, quarry stones, and cut and uncut dimensional stone

The Ministry welcomes constructive criticism and feedback about services, as well as appreciation and suggestions on how the Ministry might improve them and these can be directed to: –

The Secretary for Mines and Mining Development

7th Floor, Zimre Centre

Cnr Leopold Takawira Street/Kwame Nkrumah Avenue

Private Bag 7709 CY

Harare

General Line: +263-4-777022-4 Fax: +263-4-777044